Planning for a Natural Disaster

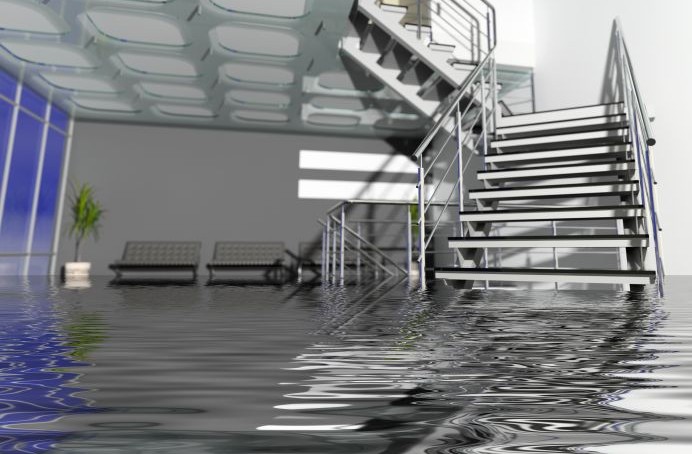

If flooding prevents you from getting to your office except via canoe, what will you do? Where will you work? Who will you call to salvage your files?

August 13, 2014 marks the tenth anniversary of Hurricane Charley hitting Florida and packing a wallop of 105 mph winds, rain and offshoot tornados. The hurricane moved off quickly, but the cleanup took significantly longer.

August 13, 2014 marks the tenth anniversary of Hurricane Charley hitting Florida and packing a wallop of 105 mph winds, rain and offshoot tornados. The hurricane moved off quickly, but the cleanup took significantly longer.

Residences destroyed or damaged by the storm were numerous. People had anticipated the storm damage and many had proactively boarded windows and prepared for the long, hot, and powerless (because the electricity was out in many areas for weeks) days after the disaster. Homeowners prepared. Many businesses did not. In the scheme of things, Charley’s damage was small compared to Hurricane Katrina’s decimation of New Orleans.

Why do I bring up these storms in a business publication for women? Because one of the most devastating things about all of these storms was the economic effect they had on the area. Business owners left work to board up their houses and protect their families, assuming that after the storm passed, they would open for business as usual. For a great many, reopening after the storm was not immediate and for a great many more, it was impossible.

When you have spent your life and life savings to build a business, even a minor setback could destroy everything you built. What is your plan if snow, flooding, hurricane, fire, or a tornado destroys your building or denies you access to your workplace for days, weeks, or months? How will you pay your employees? Where will you move your office so that customers can still find you?

Women-owned and women-run businesses are especially vulnerable because working women wear many hats. You might be owner/operator, wife, mom, and Sunday school teacher. With so many people relying upon you, your post-distaster success will depend upon the preparedness plan you created before the storm.

FEMA recommends that every size business have a preparedness plan in place. Lost revenue mixed with the additional costs of clean up can spell disaster for your business. If you are thinking, “My insurance will cover that.” Think again. Insurance will not cover all your costs, nor can it bring back customers you lost while you were closed or who cannot do business with you anymore because their own businesses were destroyed. The economic impact of a disaster, natural or manmade, is no joke. According to the Insurance Information Institute, “Up to 40% of businesses affected by a natural or human-caused disaster never reopen.”

All of the detailed information needed to create a preparedness plan for your business is found at FEMA’s ready.gov website. FEMA advocates the use of an “all hazards” approach wherein your business has a plan that can be utilized for any emergency occurance ranging from a tornado with little response time to a hurricane with several hours to implement your plan to even for an epidemic like influenza.

FEMA recommends five steps to creating a preparedness plan:

Program Management – Define the roles and responsibilities of the people who will implement your plan when the time comes. How will you protect your employees and customers in a disaster? Who has the authority to do so? How will you protect your assets? What will you do to protect your brand and reputation during a crisis? Find out what your suppliers’ disaster plan is. Will you be able to get the materials you need in the event of a disaster?

In preparing for Hurricane Charley in 2004, some offices moved all electronics equipment and important files away from windows and into centrally located rooms as a precaution. Businesses closed so that employees could go home to prepare their residences and loved ones for the storm.

Planning – Complete a risk assessment to determine the potential hazards to your business. What are the risks to your infrastructure, to people and equipment? How will you safeguard your finances and cover emergency expenses? How will you make payroll if you are snowed out of your business for days?

Implementation – You need a plan for implementing your plan. Who will move equipment, perishables or people to a safer location? How will you communicate with your employees, your suppliers or your stakeholders in a crisis? A telephone tree and the ability to work remotely could save your business during or after a disaster. Develop a business continuity plan that includes recovery strategies to overcome the distruption of your business. Train your employees to take the appropriate actions when the time comes.

Testing – Exercises to test your plan will identify weaknesses in your plan so you can correct them. Test your procedures. Determine if employees understand and can follow the plan. Can your employees hear alarms and directions throughout the facility? Can they keep calm to direct customers to safe areas? Test your emergency equipment such as defibrilators and emergency announcement systems. Time allocated for testing and exercises is not wasted time; it is crucial time that may save your sanity and your business someday.

Improvement – Every instance when part of the plan did not go “as planned” is an opportunity to improve your emergency preparedness plan. After an incident, critically assess the functionality of your plan and create a correct action plan to adapt your plan for the future.

As your business changes and grows, your emergency preparedness plan must change as well. If you are not sure where to begin to plan for emergencies, start here where you can assess the potential natural disasters in your area and find peers with whom to connect to compare notes and create plans. Once your business has a disaster plan to cover in case of a hurricane or other natural disaster you can move on to more pressing matters like who didn’t order coffee for the breakroom and who’s responsible for cleaning the fridge.

Image: Liz Roll, Beaumont, TX, 9/24/05 — debris from hurricane Katrina

TAGS: planning tips

Interviewer Interview Prep

Interviewer Interview Prep Impactful Mentees

Impactful Mentees Benefits of a Mentor

Benefits of a Mentor Advice for First-Time Managers

Advice for First-Time Managers Overcoming the 18-month Itch

Overcoming the 18-month Itch Dressing for Your Style

Dressing for Your Style Interview Style Tips

Interview Style Tips Women's Stocking Stuffers

Women's Stocking Stuffers Gift the Busy Traveler

Gift the Busy Traveler Father’s Day Gift Guide

Father’s Day Gift Guide Airport Layover Activities

Airport Layover Activities Traveling & Eating Healthy

Traveling & Eating Healthy Travel Like a Boss Lady

Travel Like a Boss Lady The Dual California Life

The Dual California Life Gifts for Thanksgiving

Gifts for Thanksgiving Summer Reading List

Summer Reading List Top Leisurely Reads

Top Leisurely Reads New Year, New Books

New Year, New Books Life Lessons from a Sitcom

Life Lessons from a Sitcom Oprah, Amy or Amal?

Oprah, Amy or Amal?